Why using an invoice book can improve your customer experience

Why using an invoice book can improve your customer experience

Blog Article

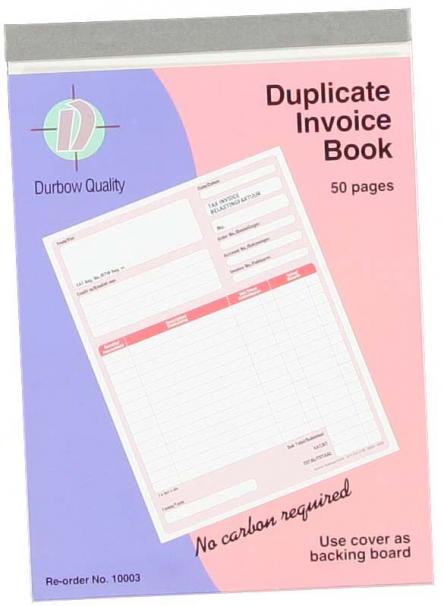

Discovering the Conveniences of Using an invoice book for Your Local Business Transactions

Making use of an invoice book in little service transactions presents several advantages that can significantly impact operations. It simplifies the paperwork process, reduces mistakes, and enhances expertise. With arranged financial documents, services can handle cash circulation more properly. As companies grow, the significance of keeping clear, organized invoicing becomes a lot more essential. Numerous little businesses forget this essential tool. What details advantages can an invoice book give as they navigate their distinct challenges?

Simplifying Transaction Documentation

When tiny services look for to improve their procedures, streamlining purchase documentation ends up being necessary. Billing books offer as a sensible device in attaining this objective. By making use of a pre-printed billing book, little organizations can minimize the moment spent on documentation and lessen errors connected with hand-operated entries. Each billing gives a structured layout, guaranteeing that all essential info-- such as date, solutions made, and payment terms-- is consistently captured.Moreover, an organized invoice publication enables simple monitoring of deals, improving record-keeping performance. This system not just facilitates quicker payment yet also help in keeping clear economic documents for tax obligation purposes. By embracing an invoice book, small companies can develop a seamless workflow that alleviates the burdens of deal documentation. Eventually, this simplification adds to enhanced functional performance, allowing company owner to concentrate on growth and customer care rather than getting stalled by administrative tasks.

Enhancing Expertise and Branding

A properly designed invoice publication can significantly improve a small company's professionalism and branding. When customers obtain invoices that reflect a cohesive brand identity-- through regular use logo designs, shade plans, and typefaces-- they view business as even more qualified and dependable. This focus to information cultivates depend on, motivating repeat purchases and favorable word-of-mouth. In addition, a branded billing publication can work as an advertising tool, discreetly reinforcing the company's picture each time a billing exists. By including an organization tagline or a quick description of services, the invoice can remind clients of the service's values and offerings.Furthermore, a specialist look differentiates a small company from competitors, making it extra remarkable in a jampacked marketplace. Eventually, purchasing a quality billing book connects commitment to quality, which can leave a long lasting impression on clients and add to lasting business growth.

Improving Money Flow Administration

Effective capital management is important for little organizations to maintain financial security and growth. An invoice publication acts as an important tool in this procedure, allowing entrepreneur to track sales and expenditures methodically. By offering clear records of purchases, it makes it possible for timely follow-ups on past due payments, which can substantially enhance cash money flow.Additionally, having an organized invoicing system assists local business owners forecast capital requires, guaranteeing that they have ample funds to cover operational expenses and unexpected costs. The visibility that an invoice book offers allows for much better decision-making pertaining to investments and resource allocation. It assists in identifying fads in customer settlement behaviors, which can assist future sales methods. Ultimately, making use of an invoice book furnishes local business with the necessary insights to manage their capital successfully, promoting long-lasting economic health and wellness.

Simplifying Accounting Processes

Streamlining Document Keeping

Efficient record keeping acts as the backbone of effective small company purchases. Making use of an invoice book simplifies this procedure by providing an organized format for recording sales and expenses. Each billing produces a concrete record, decreasing the risk of shed info and aiding in the organization of financial data. Companies can easily track repayments and superior balances, which improves total presence of cash circulation. In addition, an invoice book reduces the moment invested in management jobs, permitting owners to concentrate on core service procedures. By combining documents in one place, it eliminates complication and promotes simpler access of details when required, inevitably improving the accountancy procedure and advertising better company monitoring.

Enhancing Financial Accuracy

Accurate monetary records are important for tiny companies intending to preserve productivity and conformity. Making use of an invoice book substantially enhances financial accuracy by providing a methodical approach for monitoring sales and expenditures. Each transaction recorded in an invoice book is documented in a constant layout, decreasing the chance of errors that can arise from hand-operated entrance or electronic mismanagement. This structured method guarantees that all monetary data is arranged and conveniently accessible, making it simpler to cross-reference information. Additionally, making use of sequentially numbered billings aids stop replication and noninclusions. By streamlining audit processes, small companies can ensure that their economic information reflects true efficiency, eventually supporting far better decision-making and promoting long-term sustainability.

Improving Tax Obligation Preparation

While preparing tax obligations can usually really feel intimidating for small company proprietors, utilizing an arranged invoice book can significantly simplify the process. By methodically recording all transactions, an invoice book gives a clear overview of earnings and costs, which is necessary for precise tax coverage. The in-depth access promote easy tracking of deductible expenditures, ensuring that entrepreneur do not overlook potential tax benefits. Additionally, having all monetary documents in one location decreases the moment invested looking for records during tax obligation period. This structured technique not just reduces errors however additionally improves general efficiency, enabling small company proprietors to concentrate on their core procedures instead than be slowed down by tax obligation preparation concerns. Inevitably, an invoice book acts as a useful device in financial management.

Enhancing Client Relationships

Reliable client connections depend upon clear communication channels, which promote transparency and understanding. invoice book. By keeping professionalism and building trust, organizations can improve their online reputation and client loyalty. Additionally, providing individualized purchase documents can produce a much more customized experience, additional strengthening these essential links

Clear Interaction Networks

Regularly developing clear interaction channels is vital for enhancing customer relationships in small companies. Reliable communication cultivates openness and warranties that customers are always educated regarding their transactions. An invoice book acts as a concrete tool that documents agreements, payment terms, and purchase information, reducing the possibility for misunderstandings. By giving customers with efficient invoices, companies can improve clearness and advertise accountability. Additionally, normal follow-ups concerning billings can facilitate open discussions, enabling clients to voice worries or concerns. This proactive method not only constructs trust yet additionally demonstrates a dedication to customer care. In turn, satisfied clients are more probable to return for future purchases and recommend the organization to others, ultimately contributing to lasting success.

Professionalism and reliability and Trust fund

Professionalism and reliability and depend on are fundamental aspects in strengthening client connections within local business. Utilizing an invoice book can substantially enhance the understanding of professionalism and reliability in purchases. This tool gives regular and well organized documents, guaranteeing clients get clear and exact billing info. When clients see well-structured invoices, it promotes a sense of dependability and skills in business. In addition, prompt invoicing can help establish depend on, as customers appreciate transparency regarding their financial commitments. A specialist appearance not just reflects business's worths but likewise comforts clients that their interests are focused on. Subsequently, utilizing an invoice book can bring about boosted customer fulfillment, read more repeat organization, and favorable referrals, ultimately adding to the lasting success of the local business.

Customized Transaction Records

An invoice publication not only boosts professionalism and reliability yet also permits the creation of individualized deal records that can considerably reinforce client partnerships. By recording particular information of each transaction, businesses can customize their solutions to meet private client demands. These records enable businesses to bear in mind customer preferences, settlement background, and previous interactions, promoting a sense of attentiveness and care. Furthermore, personalized billings can include notes or acknowledgments, making customers feel valued and valued. This approach not just improves client fulfillment but also encourages repeat service and referrals. Generally, individualized transaction documents act as an effective device for building trust fund and commitment, eventually adding to long-term success in an affordable market.

Promoting Easy Record Maintaining

Efficient document keeping is crucial for small companies to preserve financial health and wellness and enhance operations. A billing book functions as a useful tool in this regard, offering an organized method for documenting purchases. By making use of an invoice book, local business proprietors can conveniently track sales, repayments, and superior balances, which helps in taking care of cash money flow efficiently.The organized format of an invoice book simplifies the process of taping transactions, minimizing the probability of mistakes that might develop from digital entrance or spread notes. The tangible nature of a physical invoice book guarantees that records are constantly obtainable for testimonial, audits, or tax preparation.This system promotes accountability, as each deal is recorded with clear information, allowing for precise record maintaining. Ultimately, an invoice book not only enhances day-to-day operations yet additionally enhances economic clarity, making it possible for small companies to make educated choices based on exact data

Supporting Business Growth and Scalability

As local business desire expand and scale, having a trustworthy invoicing system ends up being important in sustaining these passions. An efficient invoice book not only simplifies purchase procedures yet likewise enhances professionalism, which can draw in brand-new clients. By maintaining exact documents, organizations can evaluate cash money flow and identify trends, allowing them to make enlightened decisions about expansion.Furthermore, a well-organized invoicing system promotes compliance with tax obligation laws, decreasing possible responsibilities and freeing resources to concentrate on growth campaigns. As companies range, the capability to quickly generate billings and track payments becomes increasingly essential, making sure that capital remains steady.Additionally, the historical data from an invoice book can give understandings for future projecting, enabling services to establish sensible objectives. Inevitably, utilizing a durable invoicing system positions local business to adapt to market needs and take opportunities as they develop, promoting sustainable growth.

Often Asked Questions

Exactly how Do I Choose the Right Billing Schedule for My Business?

Choosing the best invoice book includes examining organization dimension, regularity of transactions, and details needs. Consider factors like layout, resilience, ease of usage, and whether digital alternatives might enhance effectiveness and organization in handling funds.

Can I Tailor My Billing Book for Branding Purposes?

What Are the Expenses Connected With Making Use Of an invoice book?

The expenses connected with using an invoice book typically include first acquisition rates, possible modification costs, and ongoing expenses for extra materials. Businesses have to likewise take into consideration time invested in managing and keeping invoices effectively.

Just how Do I Take Care Of Lost or Damaged Invoices?

When dealing with shed or harmed invoices, one should promptly develop duplicates and document the occurrence. Maintaining clear records and notifying damaged parties aids assure transparency and continuity in financial documents and connections.

Are There Digital Alternatives to Typical Invoice Books?

Digital choices to standard invoice books consist of invoicing software, mobile apps, and cloud-based platforms. These options supply functions like automation, tracking, and very easy access, boosting performance and organization for services managing their financial deals.

Report this page